SEBI Warns Against ‘Unregulated’ Digital Gold – Experts Advise ETFs

Avoid Unregulated Digital Gold: Switch to Gold ETFs, Say Experts

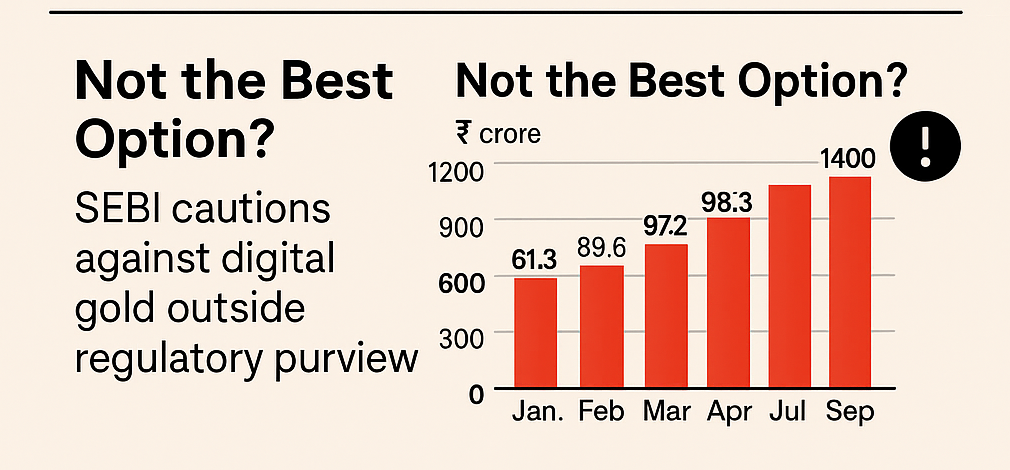

SEBI has issued a cautionary note highlighting that digital gold sold via online platforms lies outside its regulatory purview. This means investors in such instruments have no legal or institutional protection if things go wrong.

What’s Happening:

According to the National Payments Corporation of India (NPCI), users purchased ₹14,100 crore worth of digital gold in September 2025, a sharp rise from ₹761 crore in January — an 85% increase in nine months.

Concerns:

-

Lack of regulation and clarity on physical gold backing.

-

No grievance redressal in case of fraud or platform failure.

-

High transaction spreads compared to regulated gold investment options.

Finacare Insight:

Digital gold may appear convenient but lacks transparency. Investors looking for stability and safety should prefer regulated products such as:

-

Gold ETFs (exchange-traded and backed by physical gold)

-

Sovereign Gold Bonds (SGBs) issued by the RBI

-

Gold Mutual Funds managed by SEBI-registered AMCs

Investor Takeaway:

As gold prices remain firm amid global uncertainty, regulated gold investments provide both safety and liquidity — making them smarter long-term bets than unregulated digital alternatives.

✳️ Finacare Summary

India’s financial landscape is undergoing rapid transformation — driven by digital adoption, regulatory vigilance, and evolving consumer behavior.

At Finacare, we believe staying informed is the first step toward smarter investing.